- In 2023, teams are combining to score just 43.4 points per game.

- The 12.1-point margin of victory in 2023 is the largest we’ve seen since 2014.

- Underdogs have covered the spread in only 44.8% of games so far this year.

Jump to in article:

- Introduction: Where has all the offense gone?

- Analysis: Low scoring in 2023

- Is the NFL less competitive this year?

- Analysis: Penalties in 2023

- Defensive scheme breakdown

- Lack of offensive explosion

- Red Zone trips & efficiency

- Lack of offensive creativity

Where has all the offense gone this season?

If the NFL feels different this year, that’s because it is.

If it seems less exciting, less competitive, and less entertaining…that’s because it is.

No, your eyes aren’t deceiving you.

What you sense when you are watching these games is what the product is becoming.

It’s the direction the game is trending.

The product feels bland.

Superstars don’t feel as “super” this year.

Elite teams don’t feel as “elite” or unstoppable this year.

I’ve seen it on social media plenty and heard it directly from fans. There is less enthusiasm around the product and less excitement.

So, what specifically has changed? And to what extent is what we’re watching different from previous years?

It’s easiest to point the blame to defenses and their adjustments. They’ve adapted the last two years and are playing a style of defense that has reduced big plays. We’ll get into the weeds as to what they are doing differently later.

But the offensive coordinators are not blameless themselves.

Their inability to keep their quarterbacks upright (more sacks) coupled with more conservative approaches and less aggressive play calling throughout the game (early scoring vs. late scoring) and worse red zone play calling (historically bad performance) has severely hampered scoring. And we’ll dig deeply into that, as well.

And let’s not forget the NFL itself.

The new rules emphasized over the last two years have been quite “pro-defense,” and the results are unmistakable. Both at the line of scrimmage, with far fewer defensive pre-snap penalties and far more offensive pre-snap penalties, as well as in big plays, with a reduction of pass interference and an emphasis on ineligible man downfield penalties negating big plays.

I have the penalty data, and we’ll walk through it.

The collective result is what we’re seeing play out in front of our eyes:

This year, there are far fewer touchdowns (less excitement) and far fewer points scored (less excitement). Scoring output (43.4 ppg) is down to pre-2010 rule change levels.

But somehow, there are also more blowouts (less excitement) and fewer underdogs barking (less excitement). Underdogs are covering at a 44.8% rate, the worst rate we’ve seen in two decades (2003).

Even the oddsmakers, experts in setting predicted outcomes for games, can’t keep up with the lack of scoring or excitement in today’s NFL.

Case in point: Oddsmakers have set the average point total for games at 44.1 projected points scored. That’s an extremely low number. In fact, it is the lowest they’ve set average point totals since 2011. But they recognize how neutered the game is right now.

However, despite the extremely low expectations for scoring, only 38.5% of games have gone over their predicted point total. That is the lowest rate of games going “over the total” or more points being scored than predicted in more than three decades (1991).

The level of offensive impotency we are witnessing this season is simply extraordinary. This is not a slight downturn in scoring nor a blip in the radar.

There are many factors, which we will investigate, but it’s hard to imagine this is good for the NFL.

Does the NFL really want fewer points being scored, defenses given the upper hand in the rules emphasized over the last few years, fewer big plays or highlights to showcase the sport internationally, less excitement for fantasy managers, and more questionable officiating, decisions that are impacting game outcomes more directly because every yard and every point is now more important due to the reduction in scoring?

They may not want any of that. They should not want any of that.

But that is what they are getting in 2023.

So, let’s go unpack everything that has transpired these first six weeks. Let’s look at data in 2023 compared annually over the prior 10 years since 2013 to make sense of what we’re seeing and to try to put our finger on exactly what is transpiring this year.

For this entire analysis, I will be pulling data from TruMedia for Weeks 1 through 6 of each season so that the comparison is as apples-to-apples as possible.

Low NFL Scoring in 2023

In 2023, teams are combining to score just 43.4 points per game.

Last year, it was 43.3.

These last two years of scoring represent the fewest points per game scored that we’ve seen since the NFL put an emphasis on roughing the passer and illegal hits over the middle of the field on defenseless receivers back in 2010.

Immediately thereafter, starting in 2011, we saw offenses begin to pass the ball more often, and the league flourished as scoring increased.

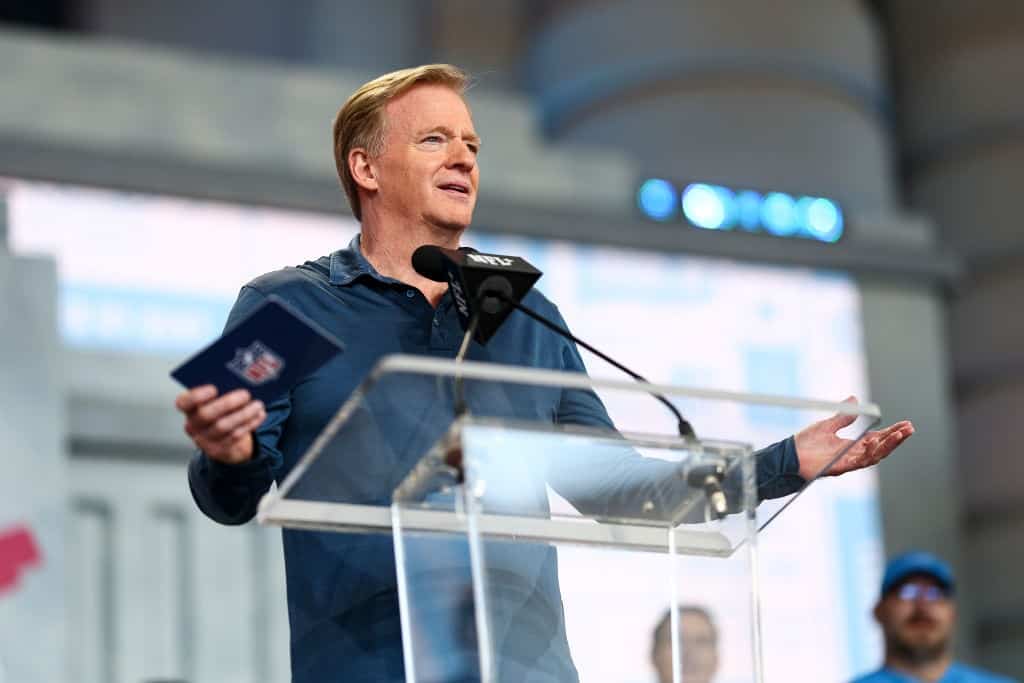

Fantasy football took off, TV viewership took off, and the popularity of the product took off, as well. This occurred only a few years after Rodger Goodell took over the NFL in 2006.

Average combined points per game by year, Weeks 1-6:

- 2010: 41.8

- 2011: 45.4

- 2012: 46.5

- 2013: 45.9

- 2014: 46.7

- 2015: 46.6

- 2016: 45.9

- 2017: 44.4

- 2018: 48.3

- 2019: 44.7

- 2020: 50.8*

- 2021: 47.8

- 2022: 43.3

- 2023: 43.4

The spike in scoring, thanks to the rule changes of 2010 and the passing revolution that followed, is apparent.

The 2020 season must be understood with the context that no fans were allowed to attend games due to COVID. As a result, road offenses received a solid boost, and collectively, teams found it easier to audible at the line of scrimmage. That resulted in a scoring rise which disappeared immediately in 2021.

In the last two years, scoring is down to levels lower than prior to the rule emphasis on protecting quarterbacks in 2010.

The initial reason why scoring increased after 2010 was pass rates, which had been in the 57% to 58% range annually from 2006 through 2010. It increased to 60 to 61% from 2011 through 2015.

But the reason scoring is down now is not because of a huge return to the ground game.

Indeed, teams are still passing at a 60.8% clip, which is within 0.3% of the 10-year average from 2013 to 2022 (61.1%).

However, as you’ll see as we progress through the entire landscape of the NFL’s changing league-wide trends, these small tenths-of-a-percent accumulate into some of what we are witnessing.

That said, we had a 60.0% pass rate in 2014, a 60.2% pass rate in 2017, and a 60.6% pass rate in the scoring explosion that was the 2020 season, and all of those seasons still saw significantly higher scoring than we are seeing in 2023, despite passing the ball more now than we did then.

Through Week 6 in 2018, we saw 328 passing touchdowns scored in 186 games played.

We’ve played 186 games this year.

Through Week 6 this year, we’ve seen just 245 passing touchdowns scored!

From 328 down to 245. 83 fewer passing touchdowns, a drop of over 25%.

While 328 was a high mark, in 2020 and 2021, we saw 318 and 321 passing touchdowns scored in the first six weeks.

We haven’t been close to that in the last two years (245 in 2023 and 257 in 2022).

This year, we’ve seen only 397 offensive touchdowns scored.

In both 2020 and 2021, we saw over 500 offensive touchdowns scored each year through Week 6.

The reason the NFL feels different is because the drop in scoring is significant.

And you can feel it when you sit on your couch and have less to jump up and down about.

The sense of a reduction in excitement is not in your mind. It is quite real.

Is the NFL Less Competitive in 2023?

Also quite real: the games aren’t as competitive.

Your initial thought with fewer points being scored is that games are now more competitive, with fewer points separating the winners from losers.

That was my thought as well.

“Offenses stink, but at least the games might be close.”

That hasn’t been the case, unfortunately.

Average margin of NFL victory by year, Weeks 1-6:

- 2023: 12.1

- 2022: 9.0

- 2021: 11.4

- 2020: 10.9

- 2019: 11.0

- 2018: 10.5

- 2017: 10.9

- 2016: 10.1

- 2015: 10.5

- 2014: 13.1

- 2013: 11.3

The 12.1-point margin of victory is the largest we’ve seen since 2014.

Games are less competitive in 2023 than in prior years, with winners doing so by larger margins.

Winners are averaging just 27.7 points per game, which is the second lowest since 2013 (only 2022 was lower at 26.2).

But where we’re seeing the biggest change is in the loser’s point total.

Teams that lose are averaging just 15.7 points per game. That is down sharply from 17.1 in 2022, which was down from 2021 (18.2), which was down from 2020 (20.0).

Teams that were forecast to lose the games based on betting markets (underdogs) are averaging only 18.9 ppg this year. That is the lowest total we’ve seen in this study (since 2013).

The average underdog line is only +4.8 points on average, which is right in line with average underdog lines during the prior 10 years (+4.9 points).

But these underdogs are losing games by 5.7 points per game, the largest margin for losses in any year in this study.

And as a result, underdogs have covered the spread in only 44.8% of games so far this year.

And that is a huge difference from prior years.

Underdog rates of covering spreads by year, Weeks 1-6:

- 2023: 44.8%

- 2022: 59.3%

- 2021: 54.8%

- 2020: 55.1%

- 2019: 60.4%

- 2018: 57.1%

- 2017: 60.2%

- 2016: 52.8%

- 2015: 53.9%

- 2014: 47.7%

- 2013: 49.4%

It’s the worst rate for underdogs in two decades (2003).

Despite very similar lines to the prior decade, underdogs have pulled outright upsets in just 34.1% of games, which is the lowest rate since 2014.

Let’s reset before we dive into the minutia…

Far fewer points are being scored. Significantly fewer touchdowns are being scored. The games are not as entertaining. The games are not as close. There are more large wins. There are fewer close games. The teams that are projected to lose aren’t as competitive. Favorites are winning more games in a more predictable manner.

It’s just not as entertaining.

Before we get into the things that are in the control of coaches, let’s first discuss what the NFL has done to cause some of this.

NFL Penalties in 2023

It is also not in your imagination that accuracy in refereeing is a problem. We consistently see inaccurate calls at key junctures of the game, with announcers and ref analysts quick to state the obvious and call out the incorrect decisions.

It’s embarrassing, and the NFL could clean it up if they figured out a fair but expeditious way to increase the accuracy of key calls.

But let’s focus less on subjectivity and more on what, specifically, the NFL has done to the game these last few years.

The NFL has tried to reduce all penalties league-wide. They made a strong effort, and the numbers are extremely clear.

Penalties by year, Weeks 1-6:

- 2023: 1,166

- 2022: 1,137

- 2021: 1,192

- 2020: 1,044

- 2019: 1,376

- 2018: 1,279

- 2017: 1,262

- 2016: 1,288

- 2015: 1,356

- 2014: 1,259

- 2013: 1,169

As little as five years ago, we saw a five-year average of over 1,300 penalties called over the first six weeks.

Fewer penalties aren’t a bad thing, though, right?

If it was across the board then I would agree.

But while a general reduction of penalties has occurred, in the last two years, we’ve seen a massive dropoff in penalties called against defenses.

Let’s focus on what has happened in the last couple of years, which may have strongly influenced the decrease in scoring over the last two years.

Defensive penalty yardage by year, Weeks 1-6:

- 2023: 4,294

- 2022: 4,288

- 2021: 4,739

- 2020: 4,735

- 2019: 4,638

Note how sharply defensively penalty yardage has dropped off in the last two years.

Let’s focus specifically on the biggest penalty: defensive pass interference (DPI).

DPI yardage by year, Weeks 1-6:

- 2023: 1,624

- 2022: 1,678

- 2021: 1,986

- 2020: 1,893

DPI yardage is down 15% in the last two years.

This has coincided with an increase in illegal contact penalties, which the NFL has emphasized.

But while illegal contact penalties have risen, from an average of 17 per season over the first six weeks from 2018-2021 up to 25 and 29 the last two years, defensive holding is down slightly.

From 2014-2019, an average of 86 defensive holding penalties were called per year over the first six weeks. But that has dropped to 66 per year in the last 4 years (including 64 this year).

The defensive penalty trends?

Fewer yards in defensive penalties, fewer yards in DPI, and more illegal contact but fewer defensive holds.

Meanwhile, we’ve seen an increase in a few various infractions on offenses.

Ineligible man downfield penalties by year, Weeks 1-6:

- 2023: 24

- 2022: 39

- 2021: 19

- 2020: 9

- 2019: 19

- 2018: 4

- 2017: 4

The “spirit” of the emphasis on ineligible man downfield penalties (RPOs) isn’t a factor as these are getting called extremely close and bringing back chunk offensive gains on non-RPO plays where a lineman drifted a foot or two beyond the imaginary line he’s not supposed to cross, despite never being involved in the downfield element of the play at all.

We saw an average of just under one ineligible man downfield penalty league-wide per week between 2013 and 2018.

We’ve seen over five times that number (5.25) called per week in the last two years.

False start penalties by year, Weeks 1-6

- 2023: 221

- 2022: 220

- 2021: 215

- 2020: 171

- 2019: 206

- 2018: 208

- 2017: 182

Though not as impactful as ineligible man downfield, false start penalties have been on the rise these last two years, as well.

But it’s not just false start penalties that are on the rise.

It’s their rise coupled with the decrease in defensive neutral zone penalties AND defensive offsides penalties:

Defensive neutral zone penalties plus offside penalties by year, Weeks 1-6:

- 2023: 91

- 2022: 68

- 2021: 84

- 2020: 100

- 2019: 110

- 2018: 105

- 2017: 119

Defenses have gained an edge at the line of scrimmage in the last couple of years.

We are seeing more false starts called while defensive pre-snap infractions have gone down significantly (a decrease of 26.7% in the last two years compared to the four-year average from 2017-2020).

As is quite apparent, like much of this analysis, there are compounding elements to all of this.

But there is no doubt the penalty emphasis the last few years has helped defensive lines rush the passer, has helped secondaries cover receivers, and has wiped out chunk offensive gains due to the far less obvious ineligible man downfield penalties.

It all adds up and ultimately plays a role in reduced scoring.

NFL Defensive Schemes in 2023

Focusing just on the last few years, as we’ve seen the largest drop in scoring within the last two years, let’s look at what defenses have been doing.