Now that free agency, the NFL Draft, and the schedule release have all passed, we have our initial layout in place in team depth charts and strength of schedule. With that, we want to take a look at some players across the fantasy landscape who are either polarizing, over or undervalued, or just interesting topics of discussion and walk through some of the pros and cons of where those players are regarded in fantasy circles. So far, we have already touched on Kenyan Drake and Austin Ekeler. Today, we are diving into second-year wideout Marquise Brown.

Week 1 Age: 23.2

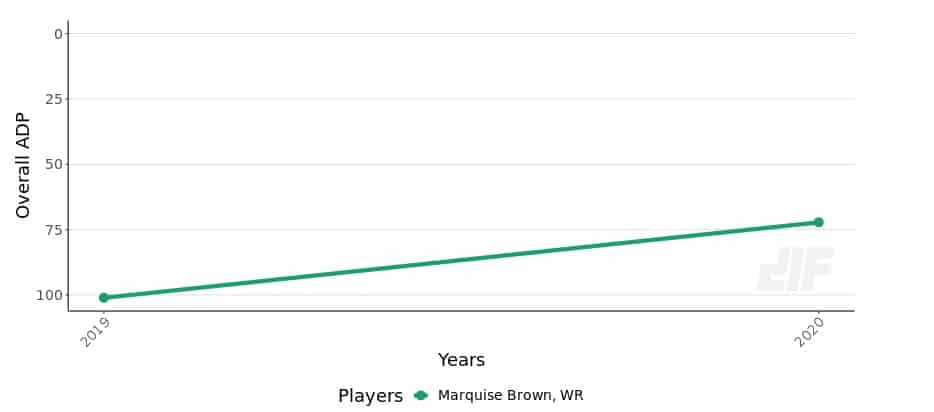

Using the Dynasty ADP tool available at Dynasty League Football, fantasy gamers are handling the success of Brown’s rookie season by bumping him up nearly 30 spots (72.2) in startup ADP compared to his rookie season (101.1). After being selected as the WR48 in startups as a rookie, he has climbed up to WR35.

As the first wide receiver selected in the 2019 NFL Draft, Brown caught 46-of-71 targets for 584 yards and seven touchdowns. Brown’s 10.5 PPR points per game were only bested by Amari Cooper (13.3) and Calvin Ridley (12.9) among the 16 first-round wide receivers selected over the past five seasons.

Brown lived up to his billing as a prospect of being a downfield asset as a rookie. He was far and away the best Baltimore target on throws 20 yards or further downfield.

Lamar Jackson Pass Attempts on Throws 20+ Yards Downfield

| Target | Tgt | Comp | Comp% | Yards | Y/A | TD | TD% |

|---|---|---|---|---|---|---|---|

| Marquise Brown | 18 | 9 | 50.00% | 334 | 18.6 | 4 | 22.22% |

| Mark Andrews | 18 | 8 | 44.44% | 224 | 12.4 | 4 | 22.22% |

| Everyone Else | 32 | 10 | 31.25% | 271 | 8.5 | 4 | 12.50% |

On an impressive note, Brown was able to have his rookie production while coming off surgery for a Lisfranc injury. Brown played his entire rookie season with a screw in his foot that has been removed this offseason. He also picked up an ankle injury in Week 5 that forced him from the game and left him inactive the following two weeks while appearing on the injury report the following three weeks after returning to the lineup. All in all, Brown only managed to play 51% of the snaps as a rookie.

2019 Game Log

| Week | Snaps | Routes | Opp | Tgt | Tgt% | Rec | Yds | TD | PPR | WR Rank |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 14 | 8 | MIA | 5 | 19.20% | 4 | 147 | 2 | 30.7 | 5 |

| 2 | 51 | 37 | ARI | 13 | 35.10% | 8 | 86 | 0 | 16.6 | 22 |

| 3 | 62 | 42 | KC | 9 | 20.90% | 2 | 49 | 0 | 6.9 | 65 |

| 4 | 56 | 37 | CLE | 7 | 20.60% | 4 | 22 | 0 | 6.2 | 60 |

| 5 | 37 | 22 | PIT | 5 | 17.90% | 3 | 22 | 1 | 11.2 | 32 |

| 9 | 40 | 17 | NE | 4 | 17.40% | 3 | 48 | 0 | 7.8 | 49 |

| 10 | 19 | 10 | CIN | 4 | 18.20% | 4 | 80 | 1 | 18 | 14 |

| 11 | 38 | 20 | HOU | 4 | 14.80% | 2 | 23 | 0 | 4.3 | 72 |

| 12 | 49 | 23 | LAR | 7 | 30.40% | 5 | 42 | 2 | 21.2 | 9 |

| 13 | 37 | 16 | SF | 2 | 8.70% | 1 | 1 | 0 | 1.1 | 106 |

| 14 | 43 | 21 | BUF | 3 | 12.00% | 3 | -2 | 0 | 2.8 | 91 |

| 15 | 47 | 23 | NYJ | 4 | 16.70% | 4 | 45 | 1 | 14.5 | 30 |

| 16 | 43 | 28 | CLE | 2 | 6.50% | 1 | 6 | 0 | 1.6 | 98 |

| 17 | 39 | 18 | PIT | 2 | 9.50% | 2 | 15 | 0 | 3.5 | 82 |

| DIV | 80 | 66 | TEN | 11 | 18.60% | 7 | 126 | 0 | 19.6 |

After returning to the lineup in Week 9, Brown managed to run just 19.6 pass routes per game throughout the remainder of the regular season, receiving just 32 total targets over those nine games after 39 targets over his first five games played.

All in all, this appears on the surface as a more or less run of the mill rookie season that had peaks and valleys, but ended up positively. That is a reason to buy. But what, if any, are the other sides to the coin that could prevent Brown from once again increasing his dynasty value a year from now, meaning this could be the highest selling point we get?

Baltimore is the Land of 2020 Scoring Regression

The first potential thorn in a major ascendance for Brown is that Baltimore as a team, their quarterback Lamar Jackson, and Brown himself are all earmarked for scoring regression in 2020.

On the team level, the Ravens scored on 57.0% of their offensive possessions in 2019, matching the 2007 Patriots for the highest scoring rate per drive since 2000. Just 10 other teams from 2000-2018 had scored on half of their offensive possessions in a season. The following year, all 10 had a decrease in scoring rate per drive with an average loss of 8.9% rate per drive. All 10 of those had a decrease in offensive touchdowns the following season with an average decrease of 14 offensive touchdowns. The Ravens scored 57 offensive touchdowns last year, so they can absolutely withstand a 14 touchdown loss and remain one of the league’s highest-scoring offenses, but we should be expecting a loss of scores regardless.

A good place to start in expected touchdowns is in the passing game. After a 3.5% touchdown rate as a rookie, Lamar Jackson jumped to league-leading 9.0% rate in 2019.

There have been 53 other quarterback seasons since the 1970 merger in which a passer hit a 7.0% touchdown rate on 100-plus attempts and then came back and hit that threshold for pass attempts the following season. Just one of those passers (Dave Krieg in 1987-1988) increased his previous season touchdown rate. Just one other passer (Aaron Rodgers 2011-2012) hit that 7.0% mark again in the next season.

Brown himself went along for the ride with Jackson in terms of finding the end zone, scoring on 9.9% of his targets, which ranked eighth among wide receivers with 25 or more targets on the season. Over the previous decade, there have been 73 qualifying wideouts to have scored on at least 8.0% of their targets at that same target threshold. Of those 73 receivers, 62 had a decrease in touchdown rate per target the following season with just 11 increasing their touchdown total from the previous season.

How High Can Brown’s Volume Rise in Year Two?

Brown can mitigate a scoring efficiency decrease with a volume spike. There is a lot of room for his targets to rise and we already seen him average nearly 8.0 targets per game over the first five weeks of the season. In games he received just five targets, he averaged 4.7 catches for 70.6 yards without even factoring touchdowns. The question is, knowing the unique Baltimore offensive scheme, where can his target level actually rise to?

The volume department is one area where natural regression for the Ravens can aid Brown. In 2019, the Ravens led for 60.5% of their offensive snaps, which was the third-highest rate behind the 2017 Patriots (68.2%) and 2011 Packers (66.4%) for teams over the past decade. Of the 33 teams that led for over 50% of their offensive snaps 2011-2018, just five increased their ahead snap rate the following season. Of those remaining 28 teams, the average passing play increase the following season was +29.

But an extra game’s worth of team passing volume may not be enough here for Brown given the parameters of the Baltimore offense. Over the past two seasons, the league rate in targeting wide receivers has been 59% each of those seasons. Jackson targeted his wide receivers 55.4% of the time in 2018 and 41.9% of the time a year ago.

Bringing this home, the buying points for Brown are that he was a high-capital rookie pick who had a positive rookie campaign while limited or injured for a stretch of the season. He is an explosive player with upside and room to keep trending positively. The other end is that he could never get to the volume levels of surrounding wideouts in price point, forcing a reliance of high-level efficiency and volatility. I am personally more on the side of the former.

While Brown could definitely not see a major spike at all in cost a year from now if his target volume doesn’t clear triple digits, I believe he is currently too cheap to not explore the upside of potential outcomes and what he did and how he was used over the opening month of the season. And now he is healthy and a year removed from surgery on his foot. I have Brown ranked as the WR27 in startup ADP and almost two full rounds over where current his overall startup price point is. That current market has him going in the same area as current rookies in Tee Higgins, Michael Pittman, and Denzel Mims, which is too low.

In dynasty, every player has potential to be both a buy and sell at the same time. You just have to find the proper context in your league on which he is valued per owner. Startup ADP and cost is not going to be an exact market for you with team context a driving force in established leagues, but here are the buy and sell point suggestions using that as guideline pending which side you fall on.

2020 Rookie Pick Value: Lower-end First/High Second (1.10-2.02)

RB Value Targets: David Montgomery, Melvin Gordon, Le’Veon Bell

WR Value Targets: Tyler Boyd, Jarvis Landry, Adam Thielen, Christian Kirk

TE Value Targets: Zach Ertz, Hunter Henry, Darren Waller